More often than ever before, the case for sustainability is primarily a business one. If you are seeking a resource to provide greater clarity around why choosing sustainability is also choosing profitability and practical approaches that translate sustainability into strategy and action, we suggest “Rethinking Strategic Management: Sustainable Strategizing for Positive Impact,” edited by Thomas Wunder.

Sustainserv thought leaders contribute chapter

Four Sustainserv executives – Andrew Mountfield, Matthew Gardner, Bernd Kasemir and Stephan Lienin – contributed the chapter “Integrated management for capital markets and strategy: The challenges of ‘value’ vs. ‘values’ sustainability investment, Smart Beta and their consequences for corporate leadership.”

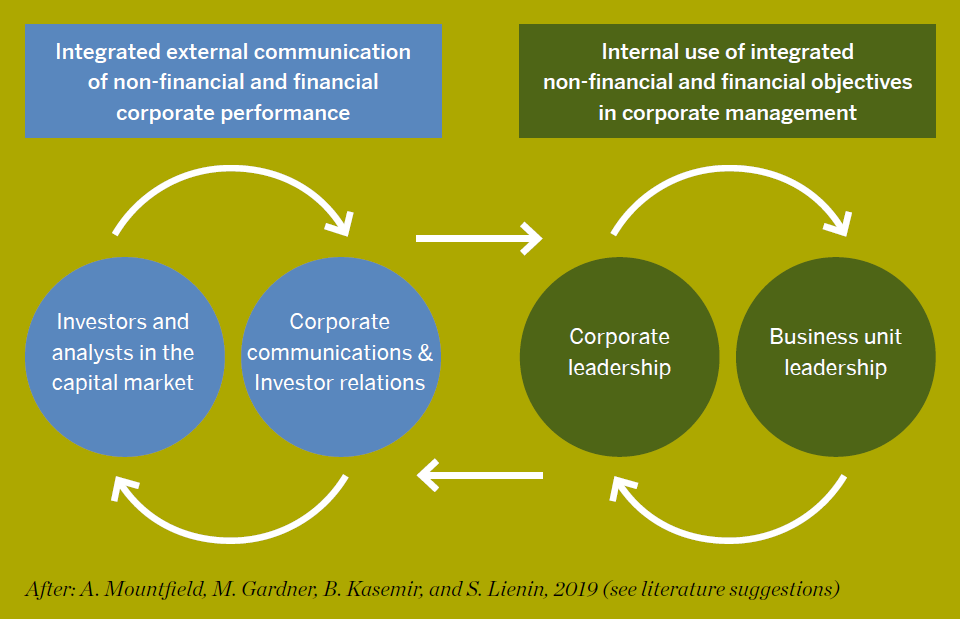

To date, sustainability strategy and reporting has largely focused on the integration of financial and non-financial data. However, a silent but dramatic revolution in financial asset management markets has occurred, as accounting for risk factors related to sustainability has become mainstream. To navigate these changes, companies must develop and align two integrated process loops.

First, the information requirements of rating and ranking organisations and asset managers must be addressed. As increasingly sophisticated techniques, such as “Smart Beta” or “factor investment” are used to isolate specific ESG-related risk or opportunity factors, the demands on companies to steer, manage and align information flows will increase. This will require greater engagement of capital market actors in a dynamic dialogue aligning analysis and risk assessment.

Second, an equally important and challenging process loop must integrate internal and external financial and non-financial objectives and indicators in a common, operational framework. This will help drive strategy implementation and reporting within the enterprise to ensure sustainable value creation.

These two process loops will require the attention of company leaders to ensure effective external communication and integrated management of strategy design and delivery.

Integrated strategy: Combining financial and non-financial objectives to create value

Successful strategy execution requires crafting a compelling story that both sets the direction and also optimizes and steers the strategic performance culture of the organisation. While it is possible to develop and implement a stand-alone sustainability strategy, integrating sustainability objectives into the corporate strategy, ensures that all factors that potentially influence value creation are considered and acted upon.

Sustainserv has further developed the Strategy Map concept developed by Robert Kaplan and David Norton to ensure the successful integration of business and sustainability strategies. When properly executed, a Strategy Map is a one-page summary of the 20-25 most important strategic objectives for a company in summary form and links the drivers of strategic success to financial results. The Sustainable Strategy Map plots financial and non-financial objectives to six value-creating capital types, utilising the IIRC Integrated Reporting categories. Objectives that drive financial value creation, such as stakeholder relationships, intellectual, human capital or natural capital are laid out in a one-page summary overview allowing the organisation to “tell the story of their strategy”. These objectives are then made operational by defining performance indicators and targets to be achieved, while laying out the actions and projects required to enable strategy execution. Sustainable strategy can so be cascaded down through each level of the organisation in an integrated and consistent manner, collectively driving value creation throughout the enterprise.

The book is available for purchase in hardcover or eBook from Springer, here.

Get in touch. We are happy to tell you more about it.