Challenge

Preparation of a non-financial report in accordance with the new GRI Standards 2021 and involvement of numerous new internal stakeholders and experts.

Goal

LGT is an international financial services company based in Vaduz in the Principality of Liechtenstein. The bank committed itself to sustainability in the financial industry at an early stage; long-term and sustainable thinking and action have always been core elements of its business activities. Sustainable commitment is practiced at LGT on both the operating and investment sides.

Since 2012, LGT has regularly published a sustainability report that is informally oriented towards the the guidelines of the Global Reporting Initiative (GRI) but that does not formally implement the GRI Standards. For the financial year 2021, LGT decided to report in accordance with the GRI Standards 2021 for the first time. For this purpose, a separate non-financial report was conceptualized, which complements the existing client-oriented sustainability report with technical and detailed information, meets market expectations and regulatory requirements, and at the same time provides a comprehensive picture of LGT Private Banking’s contribution to sustainable development.

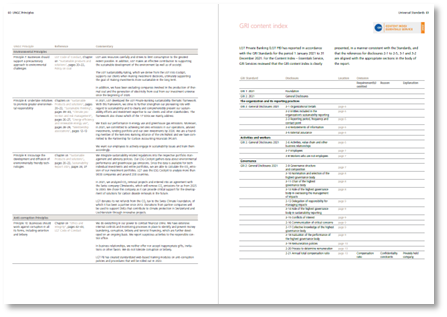

GRI Standards 2021

To meet growing stakeholder demand for transparency, GRI has revised the Universal Standards 2021. The changes mainly concern the integration of human rights, the method for assessing materiality, and the consideration of growing regulatory requirements.

Organizations that aim to report in accordance with the GRI Standards must align their reports with the new GRI Standards 2021 no later than January 1, 2023.

Our Approach

In 2021/2022, we supported LGT Private Banking in its non-financial reporting in accordance with the GRI Standards 2021, in the implementation of the PRB (Principles of Responsible Banking) Report and in the preparation of the UNGC (UN Global Compact) Communication on Progress.

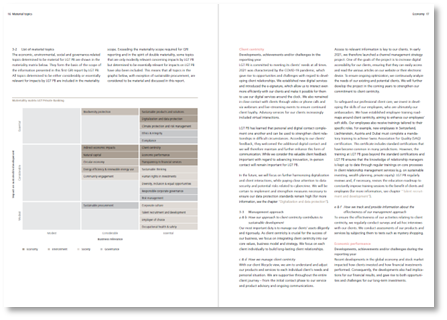

The basis for the preparation of the report, and for further development of LGT Private Banking’s sustainability management, was a materiality analysis. In accordance with the principle of dual materiality, we assessed a large number of potentially material “E-ESG” (economy, environment, society, governance) topics in terms of their inputs and impacts. In order to be able to present an analysis that is as broadly based as possible, a large number of internal experts were involved.

Where appropriate, internal stakeholders were also involved in the reporting process following the materiality analysis. Although this increased the complexity of the reporting process, it allowed valuable expertise and experience from different areas to be incorporated into the report development.

For the report development, we specified which quantitative data was required to meet the relevant disclosure requirements of the GRI standards. We assisted LGT Private Banking in collecting this quantitative data and prepared it in the form of graphs and tables.

For the preparation of the report texts with qualitative information, we conducted interviews with the people responsible for the topics at LGT Private Banking. In addition, we prepared specific questionnaires for the collection of qualitative information. We also focused on the collection and preparation of information on sustainability governance and the integration of human rights into policies – both key areas of the GRI Standards 2021.

Based on the qualitative information and quantitative data collected, we worked closely with LGT Private Banking to develop building blocks for the report, which includes GRI disclosures, management approaches, content index, strategic sustainability fundamentals, and a chapter on PRB and UNGC.

“Sustainserv fully supported us in the process of report preparation with analysis and conceptualization work, data and information collection, and writing and editing work.”

Peter Segmüller, Sustainability Manager, LGT Private Banking

Results

The decision to publish a report in accordance with the GRI Standards allowed LGT Private Banking to present its activities in the area of sustainability in an even more structured manner and to further sharpen its focus on sustainability issues, as the report shows where it stands on the key topics. Reporting in accordance with the revised GRI Standards is, on the one hand, a communication tool and, on the other hand, it helps the company to continuously develop in terms of sustainability.

“The report according to GRI Standards helps us to meet the transparency requirements even better.”

Ursula Finsterwald, Head Group Sustainability Management, LGT

With the published report, LGT Private Banking is one of the first companies to report according to the revised GRI Standards. LGT Private Banking is thus taking on a pioneering role in sustainability reporting.

Get in touch. We are happy to tell you more about it.