In today’s business world, stakeholders expect managers to be able to comment on key business areas such as strategy and risk management. In the area of ESG (Environmental, Social, Governance), there is still often a lack of clarity from management. It is crucial that companies take ESG issues seriously and integrate them into their business strategies and management.

Two important sets of regulations in Europe and Switzerland, the European Sustainability Reporting Standards (ESRS), a clarification of the Corporate Social Responsibility Directive (CSRD), and the Task Force on Climate-related Financial Disclosures (TCFD), set standards and expectations for companies in relation to sustainability and climate.

Both sets of rules emphasize the importance of integrating ESG and climate risks into corporate strategy and management. Companies that implement these regulations only minimally risk high costs without corresponding benefits, while strategic implementation creates real added value.

The world has turned upside down

When asked by a journalist why a manufacturer will only offer heavy, high horsepower vehicles in the future, the manufacturer answers the CEO of the company “you’ll have to ask my strategy department, I can’t answer that”. Or like this: When asked by financial analysts, the director of a bank cannot say how high the default risk in her loan book is. The manager’s lapidary answer: “I don’t know the answer, that’s what our risk management department calculates”. Absurd, isn’t it? One must be able to expect management to be able to provide information on the essential aspects of a business, such as strategy and risk management.

However, when it comes to ESG issues, such answers from senior managers are not agenda. This is because ESG risks are often still seen as non-material and therefore underestimated. How can you actually tell that a company is not greenwashing, but is seriously addressing ESG issues and seriously dealing with the associated risks? Companies that seriously deal with ESG do not do so. The key issues are not dealt with in the proverbial “quiet chamber”, but are anchored in the company in such a way that they can influence the actions of management and supervisory bodies, that they are embedded in the corporate strategy, and that they are monitored, measured, and monetized as opportunities and risks.

“Important ESG issues, as identified by the company as material, must become part of the organizational DNA.”

This is the essence of two new regulations that companies in the EU and Switzerland must apply. One is the European Sustainability Reporting Standards (ESRS), a kind of reporting framework that details and specifies the Corporate Social Responsibility Directive (CSRD). On the other hand, these are the OR requirements in Switzerland, in particular the regulations on climate reporting according to the Task Force on Climate-Related Financial Disclosures (TCFD). Let’s look first at the CSRD, then at the TCFD.

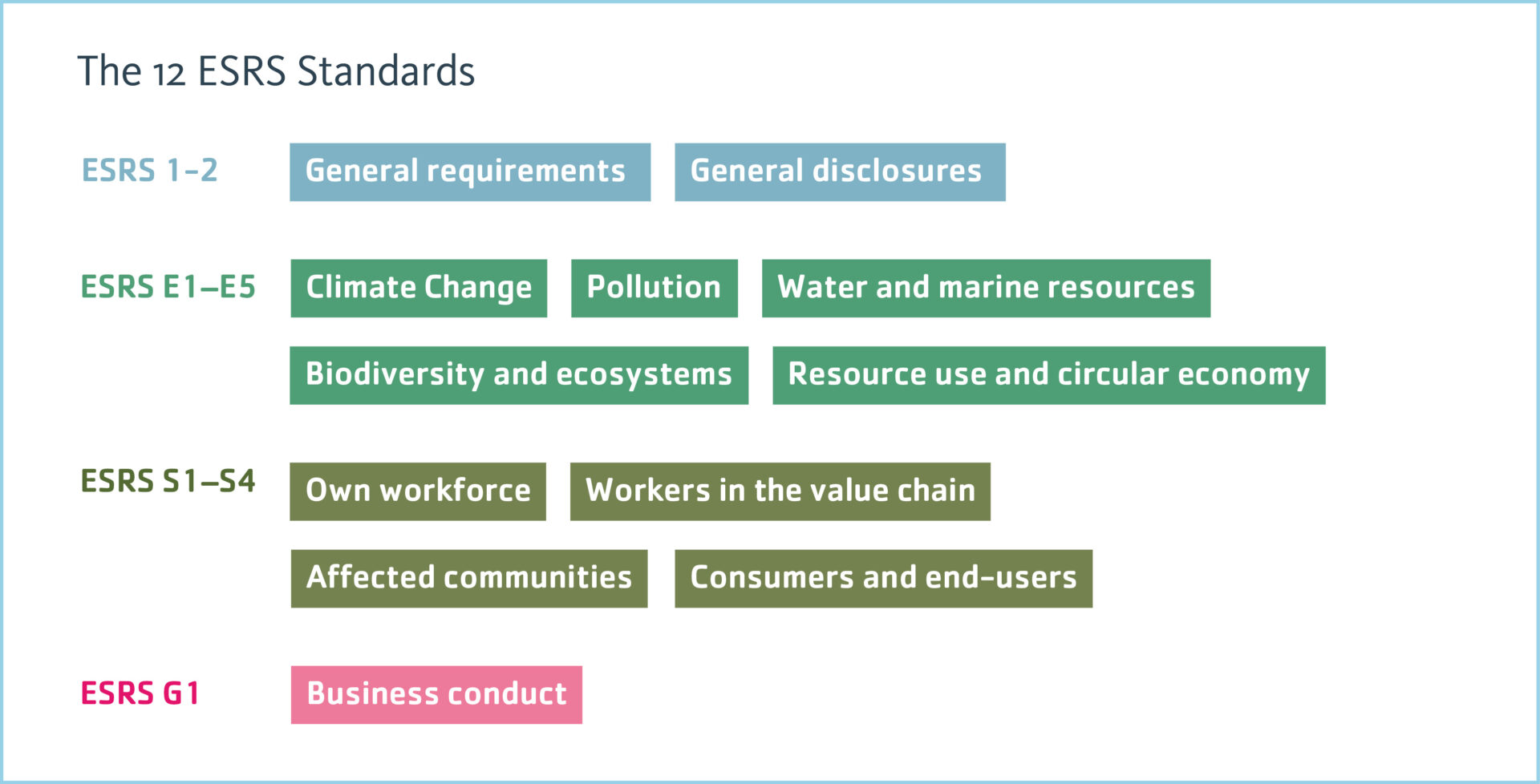

Whereas the CSRD’s predecessor, the NFRD, specified only general subject areas for reporting, the European Sustainability Reporting Standards (ESRS) clarifies and details the reporting requirements of the CSRD. Reports according to ESRS must be subjected to an external audit to increase their reliability and accuracy.

The core of the ESRS is the performance of a materiality analysis, in which the effects of the company’s activities on the environment, society and the economy, as well as the effects of the environment and society on the company, are determined through the involvement and participation of stakeholders.

“Implementing the requirements of ESRS requires embedding the wide range of ESG issues into the core processes of corporate management – a requirement that CSRD and TCFD have in common.”

Another striking feature is the structure of the ESRS standards for topics such as the environment, human resources or corporate governance. Each individual standard, which is divided into subtopics, sub-subtopics and disclosure requirements, contains requirements for information on how the topic is managed by the management (Governance), in what form the topic is strategically significant (Strategy & Business Model), and whether it is measured for risks and opportunities (Impact, Risks & Opportunities).

Sustainserv is currently working on numerous customer projects in a wide range of industries to check existing sustainability processes for their suitability for ESRS. Companies that already report in accordance with GRI have a head start over those that are implementing sustainability for the first time as part of the ESRS, but they have to do more than just polish a few edges and regroup topics.

While Switzerland’s sustainability reporting is at the level of the NFRD, the predecessor of the CSRD in the EU, i.e. it is lagging behind, it is ahead in terms of climate reporting:

“It is important that climate aspects and climate-related risks are embedded in the organizationally important staff functions such as strategy and risk management.”

With the adoption of the ordinance on mandatory climate reporting, the Swiss Federal Council has stipulated that large Swiss companies must implement the TCFD recommendations and report for the first time in 2025 for the 2024 reporting period. We believe that the EU will also follow this global trend sooner or later and make TCFD mandatory for companies based in the EU. It is therefore also worthwhile for German companies to take a look at the TCFD.

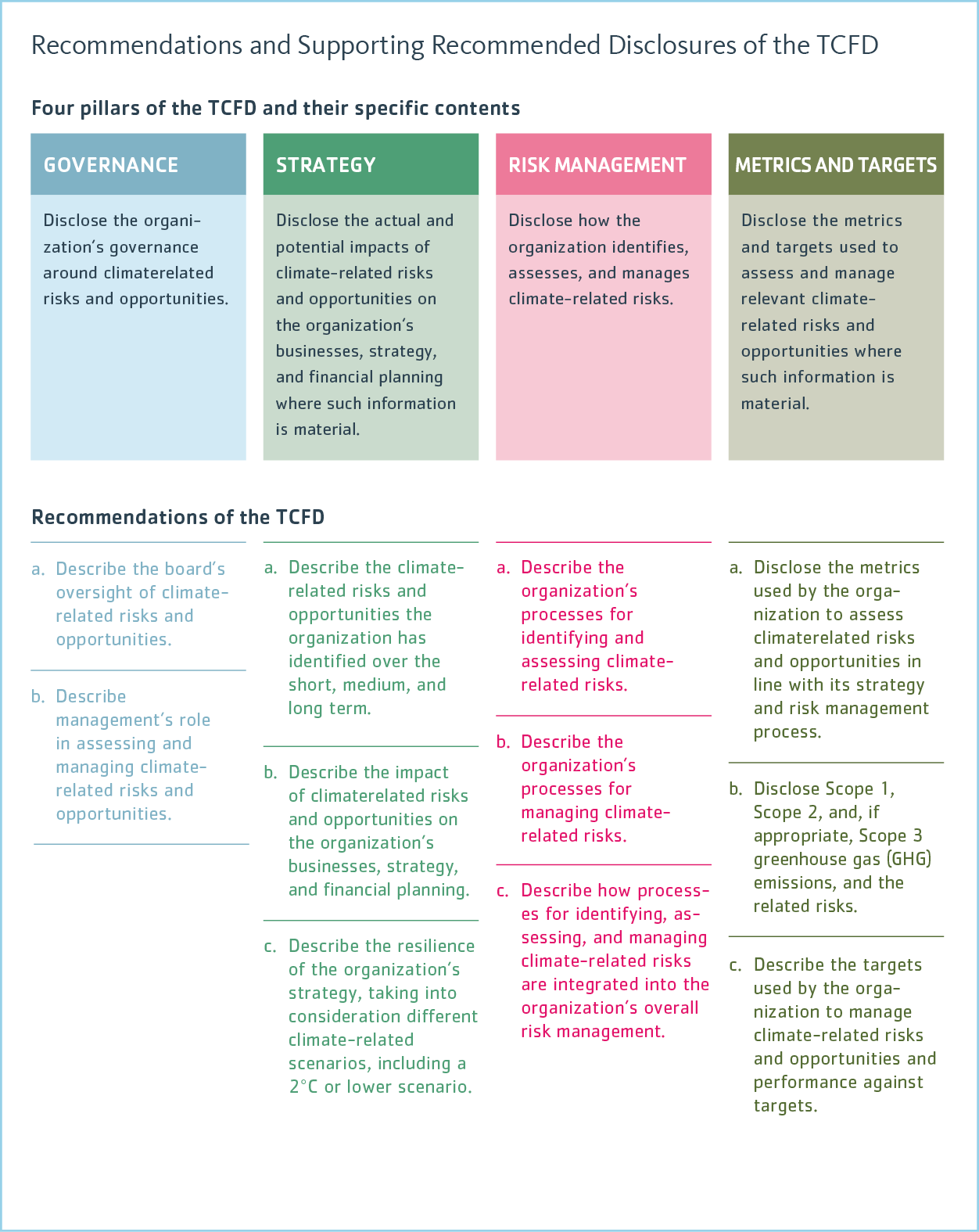

The Task Force on Climate-related Financial Disclosures (TCFD) was established to develop uniform disclosure standards on climate-related financial risks for companies that provide information to investors, lenders, insurers and other stakeholders. The objective of the TCFD is to improve the ability of financial markets to properly assess and price climate-related risks and opportunities. The TCFD is based on four pillars that reflect the key topics. Although the TCFD recommendations give companies some flexibility in deciding where to disclose the information (e.g. in financial reports, sustainability reports or on websites), an application that follows the philosophy of the TCFD offers little flexibility.

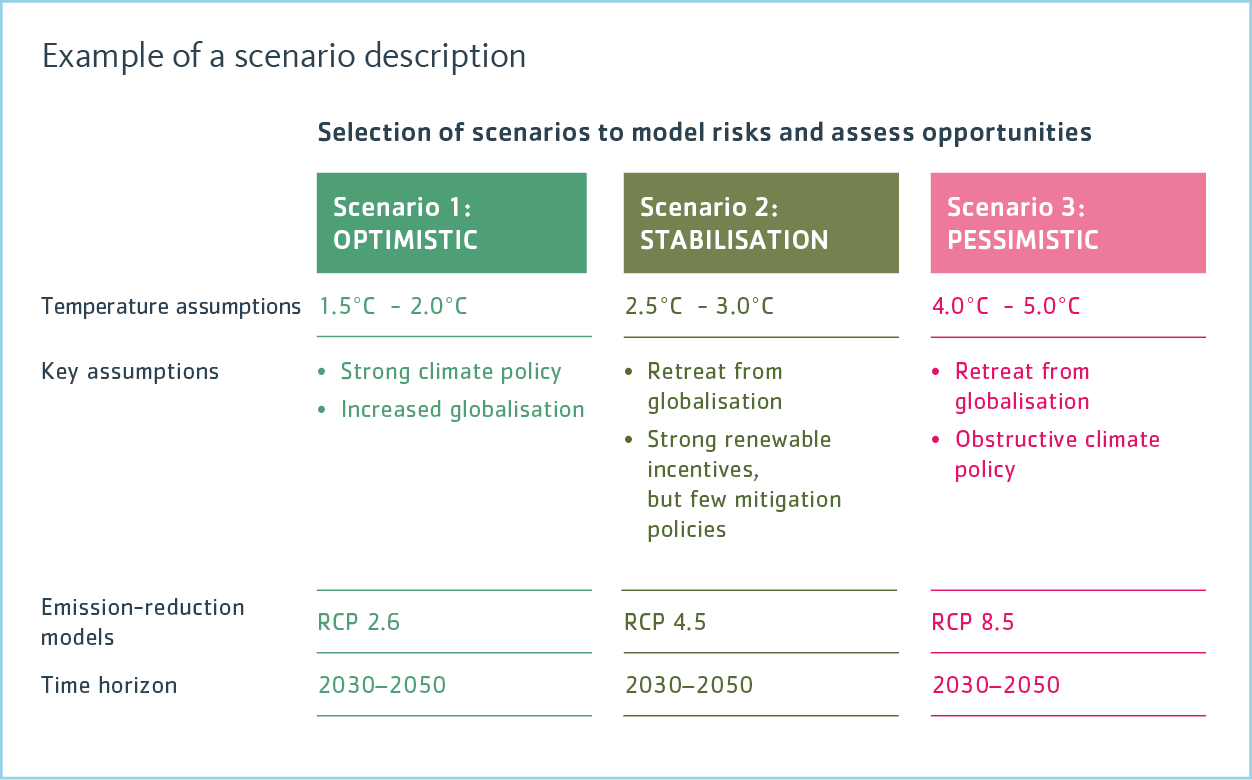

If the TCFD recommendation is implemented, the company must consider how senior management (supervisory board, board of directors, executive board, senior management) deals with the issue of climate (“is this already the case today?”); whether and to what extent climate-related physical and transformational risks are included in the strategy (“climate – driver or marginal issue in the strategic debate?”); whether and how such physical risks, such as extreme weather situations, or transformational risks, such as changes in consumer behavior or stricter regulation, are already calculated by the established processes and methods in risk management (“or does the risk management department not yet know anything about climate risks?”), and last but not least, whether climate is discussed rather abstractly and casually or whether important aspects such as CO2 emissions are not only already measured, but targets such as reduction paths also exist. Climate scenarios such as those used by our customer Heidelberg Materials are important tools for defining reduction paths. Climate scenarios make it possible to think through different futures in terms of their risk and opportunity potential and their impact on the company.

Even if you consider CSRD/ESRS or TCFD to be excessive and are particularly bothered by the effort involved in implementation, you should not implement regulation half-heartedly. Anyone who is tempted by excessive demands in dealing with regulation to stubbornly implement only what is formally sufficient for coverage will end up with a poor cost-benefit ratio. On the other hand, a strategic approach to regulatory requirements creates real added value (reputation, new products, energy efficiency, maintaining supplier relationships with large corporations, etc.).

So what to do? Four recommendations

- Involve your strategy, risk management and finance staff functions in ESG at an early stage. ESRS and TCFD are not niche topics, but mandatory and therefore business-relevant.

- Create the infrastructure (processes, systems, methods) to collect and evaluate climate and sustainability data efficiently and systematically using the same scope of consolidation that you use for financial data.

- Applying ESRS and TCFD means thinking about supply chains, both “upstream”, i.e. the contribution of your suppliers, and “downstream”, i.e. the use of your products or services by customers. Even if climate may not seem particularly important to you at first glance, it may be to one of your key suppliers or one of your most important customers.

- Communicate broadly across the entire organization, including your stakeholders, that you take the real-world issues that are commonly subsumed under ESG seriously. Here too, the “tone at the top”, i.e. how you deal with them, is crucial.

We at Sustainserv support you in the implementation of the ESRS with its 12 standards and over 100 disclosure requirements, as well as in the application of the TCFD including all four thematic elements – governance, strategy, risk management as well as key figures and targets – in practice.

This article was published as a supplement in The Reporting Times of the Center for Corporate Reporting and can be downloaded in German here as a PDF.

Get in touch. We are happy to tell you more about it.