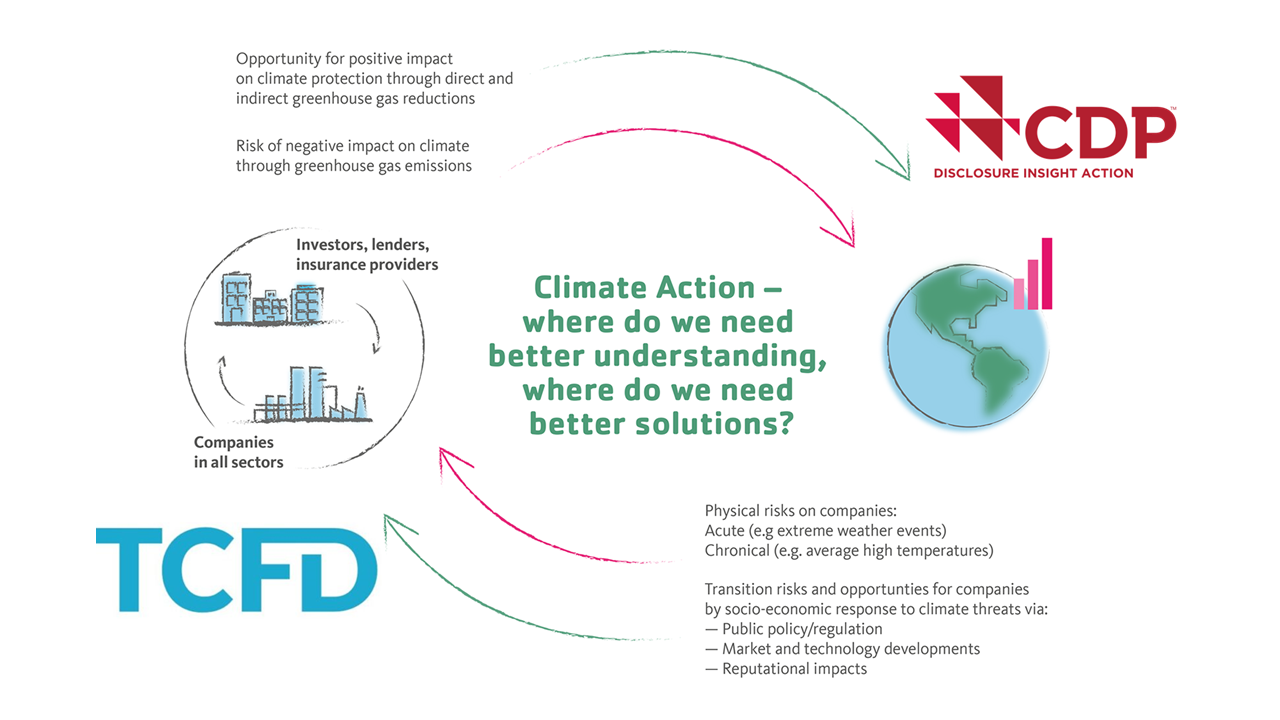

The Task Force on Climate-related Financial Disclosures, better known as the TCFD, is an initiative launched in December 2015 by the FSB (Financial Stability Board), an international body founded, with support from G20 members, to promote international financial stability. The purpose of the TCFD is “to help identify the information needed by investors, lenders, and insurance underwriters to appropriately assess and price climate-related risks and opportunities,” 1 and “to make recommendations for consistent company disclosures that will help financial market participants understand their climate-related risks.” 2

TCFD issued formal recommendations in 2017

In 2017, the TCFD published its final recommendations, as charged by the FSB. These recommendations provide a framework for developing more effective climate-related financial disclosures through existing reporting processes.3 Additionally, the TCFD released annual status reports in 2018, 2019 and 2020, which describe year over year progress toward TCFD recommendations among the private and public sectors.

As written in the Executive Summary of the final recommendations, “The financial crisis of 2007-2008 was an important reminder of the repercussions that weak corporate governance and risk management practices can have on asset values. This has resulted in increased demand for transparency from organizations on their governance structures, strategies, and risk management practices. Without the right information, investors, for example, may incorrectly price or value assets, leading to a misallocation of capital.” Understood in this comment is that for too long, the “right information” has not included climate-related data that has material impacts on financial risk.

“The Task Force’s recommendations are intended to help build consideration of the effects of climate change into routine business and financial decisions, and their adoption can help companies demonstrate responsibility and foresight. Better disclosure will lead to more informed and more efficient allocation of capital, and help facilitate the transition to a more sustainable, lower-carbon economy.”

Michael R. Bloomberg, Chair, TCFD, 2020 Status Report, September 22, 2020

TCFD developed four widely adoptable recommendations.

The four recommendations of the TCFD are tied to governance, strategy, risk management and metrics. They are as follows:

- Governance: Disclose the organization’s governance around climate-related risks and opportunities.

- Strategy: Disclose the actual and potential impacts of climate-related risks and opportunities on the organization’s businesses, strategy and financial planning where such information is material.

- Risk Management: Disclose how the organization identifies, assesses and manages climate-related risks.

- Metrics and Targets: Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material.

The four recommendations share the following key features:

- Adoptable by all organizations

- Included in financial filings

- Designed to solicit decision-useful, forward-looking information on financial impacts

- Strong focus on risks and opportunities related to transition to lower-carbon economy

TCFD is not just another reporting framework. While frameworks like CDP help understand the effects that companies have on climate change, the TCFD is focused on the effects of climate change on companies and resulting financial risks. It is forward-looking by nature.

Why is the TCFD important?

It has become clear to the current generation of financial leaders that climate-related risk has material impact on financial markets. Ignoring this data is no longer an option, and companies that heed the TCFD recommendations sooner rather than later will benefit from stability, resiliency and profitability. Because the TCFD has support from the G20, the recommendations are held as credible by countries and companies around the world and has great potential to effect global change.

Switzerland joins dozens of governmental entities in support of the TCFD

More than 110 regulators and governmental entities support the TCFD. In line with the country’s policy on sustainable finance, Switzerland became an official supporter of TCFD on January 12 of this year, and reporting according to the TCFD recommendations will become mandatory for all listed companies in Switzerland. Both the Federal Council as well as the Swiss Financial Market Supervisory Authority (FINMA) are working on respective proposals. Even though the details of the new requirements are not yet clear, it is now the time to familiarize yourself with the recommendations and start preparing their implementation.

“The TCFD is committed to market transparency and stability. We believe that better information will allow companies to incorporate climate-related risks and opportunities into their risk management and strategic planning processes. As this occurs, companies’ and investors’ understanding of the financial implications associated with climate change will grow, empowering the markets to channel investment to sustainable and resilient solutions, opportunities, and business models.”

Task Force on Climate-related Financial Disclosure

Growing support for TCFD recommendations among leading global companies

As described in the annual status reports, adoption of the recommendations continues to trend upward. The TCFD now has the support of 1,700+ signatory organizations worldwide, including the world’s largest asset managers.

Key findings from the 2020 Status Report include:

- Nearly 60% of the world’s 100 largest public companies support the TCFD, report in line with the TCFD recommendations, or both.

- Disclosure of climate-related financial information has increased since 2017, but continuing progress is needed.

- Energy companies and materials and buildings companies lead on disclosure.

- One in 15 companies reviewed disclosed information on the resilience of its strategy.

- Asset manager and asset owner reporting to their clients and beneficiaries, respectively, is likely insufficient.

- Expert users find the impact of climate change on a company’s business and strategy as the “most useful” for decision-making.

- Expert users’ insights on the most useful information for decision-making may provide a road map for preparers.

Our recent TCFD work for Swiss Prime Site

We guided the leading real estate company Swiss Prime Site through the process of creating their TCFD-report on climate-related financial risks. The report shows how Swiss Prime Site identifies and manages physical and transitional risks caused by climate change that can have a financial impact on the company.

How to stay updated on TCFD developments

As the TCFD continues to inform the world’s leaders about acknowledging climate risk as a means to improve performance and transition to a lower-carbon economy, companies are wise to keep their eyes on the TCFD. The following resources are helpful for fully understanding the TCFD, its mission and recommendations, access to online courses and updated information on expanding support.

The Task Force on Climate-related Financial Disclosures (TCFD), official website

Final Recommendations from the TCFD

TCFD Knowledge Hub and Online Courses

News and Media Coverage of the TCFD

1 https://assets.bbhub.io/company/sites/60/2020/10/FINAL-2017-TCFD-Report-11052018.pdf

3 https://assets.bbhub.io/company/sites/60/2020/09/2020-TCFD_Status-Report.pdf

Get in touch. We are happy to tell you more about it.