1. The EU Sustainable Finance Action Plan sets clear and far-reaching requirements for financial institutions: in short, they need to change in order to adapt.

The EU wants to redirect capital flows toward sustainable investments and anchor sustainability in risk management. These objectives stem from the Sustainable Finance Action Plan adopted by the European Commission in March 2018 and from the “European Green Deal” presented in December 2019. As a result, the interfaces and cooperation between financial institutions and companies in all sectors will change significantly.

Within the DACH region, this directly affects financial service providers in Germany and Austria. However, institutions in Liechtenstein and Switzerland will also be affected, due to gradually tightening requirements in the European Economic Area (EEA), regulatory adjustments to secure EU market access for Swiss financial service providers, and the rising expectations of all market participants.

BaFin agrees to stricter ESG rules …

(Börsen-Zeitung, 6 May 2020)

The German Federal Financial Supervisory Authority (BaFin) recommends that the financial industry prepare for stricter European regulatory requirements regarding sustainability criteria, stress tests and capital adequacy linked to corresponding risks.

2. Risk management is the linchpin of the implementation of Sustainable Finance.

The German BaFin, for example, relies on an integrative approach and sees “sustainability risks” as additional factors in known types of risk. It does not consider “sustainability risk” as a separate risk type in itself (as explained in a BaFin brochure on dealing with sustainability risks).

3. Sustainability will be incorporated into numerous laws and regulations; thus strategy, core processes and reporting must be aligned with Sustainable Finance.

With the upcoming regulation, the EU aims to influence behavior toward sustainability. The Transparency Directive and the Taxonomy Directive are two of the many regulations that financial service providers will face in the coming years. The EU would like to use them to address three current problem areas:

- Limited consideration of ESG (Environmental, Social & Governance) by banks, asset managers and institutional investors

- No clear definition of sustainability

- Too little corporate sustainability in the market

Frank Pierschel, Chief Sustainability Finance Officer of BaFin, ” I believe that at the latest when the EBA (European Banking Authority ) comes out with the first guideline on sustainable finance, things will no longer stay quite so liberal in the application for us.”

(Börsen-Zeitung, 6 May 2020)

4. Sustainability must be integrated into all products and services in the securities business, but also in the credit and corporate customer business.

It will be required that clients, such as private investors and smaller institutional clients, are provided with sustainable investment opportunities. Therefore, financial service providers need to ensure that the customer is adequately informed about sustainable investments. This also affects larger institutional investors and asset managers, who are required to disclose their investment strategies, effective investments, and thus their “ESG footprint” (Action Plan Requirement #7).

The increasing use of ESG data by investment advisors, institutional investors and asset managers also means that data service providers and sustainability rating agencies that work with these market participants will apply even more ESG criteria and demand ESG data (Action Plan Call #6).

The EU will also now expect senior management of companies to manage companies in a sustainable manner. The demand for sustainable corporate governance (Action Plan Demand #10) includes the EU’s expectation that sustainability be integrated into corporate risk management.

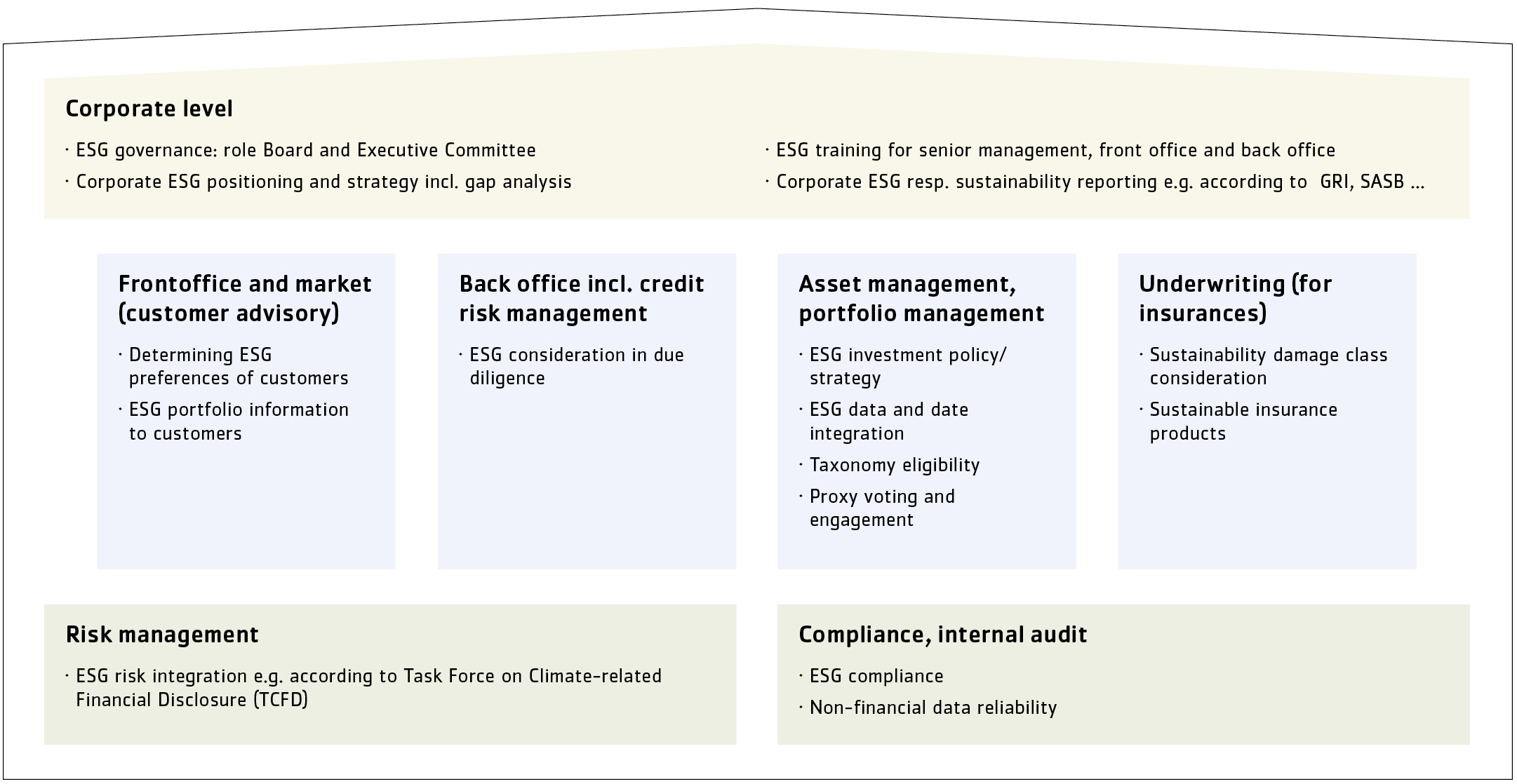

5. As sustainability affects all areas of financial services, the Management Board must determine the strategic relevance for the organization. On this basis, operational areas such as sales, advisory and back office must be enabled to readily answer customers’ questions regarding sustainability.

Financial service providers of all sizes will have to strategically decide what Sustainable Finance means for them and how they can react to increasing requirements and expectations meaningfully. This involves a forward-looking strategic anchoring as well as action plans to avoid compliance vulnerabilities.

We support financial service providers in the gradual implementation of sustainable finance. For example, the following provides an overview of modules on sustainability or ESG (Environmental, Social & Governance) that financial service providers can complete step by step:

We recommend the following steps as a “starter kit” to engage in the process and address typical challenges:

- Analyze previous ESG practice and structures.

- Ensure ESG governance and integration in the strategy.

- Develop or supplement ESG investment policy.

- Establish ESG due diligence in credit risk management.

- Introduce or firmly anchor ESG in risk management.

- Disclose ESG objectives and performance in systematic reporting.

Download

Get in touch. We are happy to tell you more about it.