Institutional investors, asset managers, financial institutions and other stakeholders are increasingly using environmental, social and governance (ESG) ratings and rankings to evaluate and measure the ESG performance of companies over time and against their peers. Expectations of good ESG performance are becoming mainstream, as evidenced by the fact that the world’s largest institutional investors, such as State Street, are now demanding active accountability on ESG issues from the companies they invest in.

Why ESG ratings and rankings are important

Over the last decade it has become increasingly apparent that a company’s performance along environmental, social and governance factors are highly correlated with its investment value – most specifically its risk. Companies with high ESG ratings are more likely to have lower risk, which appeals to investors. 1 2 3

ESG performance is becoming more measurable, and more investors are taking ESG data into account. Large institutional investors are interested in risk mitigation, higher returns and external demand, and ESG ratings can often help identify companies that match an investor’s requirements.

ESG ratings have value for the companies as well. The requirements of ESG questionnaires often promote awareness of the importance of ESG management throughout a company. The process stimulates internal discussions that can uncover future risks and opportunities. By participating in ESG ratings, companies can improve shareholder relations, increase investment, access a lower cost of capital and drive strategic decision-making.

What investors want

Investors want companies to focus on what is material to the business, more fully integrate ESG information into financial statements and improve the disclosure of ESG data. They want to collect and compile timely ESG data in a way that minimizes their time required. As a result, investors prefer to receive ESG data all at once, ideally through short ESG fact sheets rather than long reports.

In addition to better data, investors want information on how management thinks about ESG and how ESG fits into corporate strategy. They want to see involvement from not only sustainability teams, but also the CEO and CFO. For more in-depth insight, we encourage you to read the Rate the Raters report from The SustainAbility Institute by ERM.

Client Example: Swiss Life, Switzerland’s leading life insurance provider

As a Swiss stock exchange listed company, Swiss Life had to respond to numerous individual inquiries by many ESG rating and ranking agencies. Swiss Life increasingly struggled to keep up with the ratings’ demands and the rising workload to gather and synthesize the required data.

Our first step was to see how Swiss Life was assessed in different ratings and rankings and how the company compared to its peers. We then helped identify the ESG ratings and rankings most relevant to Swiss Life and its investors. By finding patterns in the data requirements and methodologies of the agencies Swiss Life prioritized, we compiled an overview of data and information meeting their demands. The resulting ESG fact sheet now helps analysts easily find the information they are looking for, which in turn reduces the effort required by Swiss Life to respond to individual inquiries.

The ESG market is deep, wide and complex

According to The Reporting Exchange platform of the World Business Council for Sustainable Development (WBCSD), there are over 40 ESG ratings, 150 ESG rankings and 450 ESG indices, not including the large number of investment banks, governmental organizations and research institutions, who conduct their own ESG-related research that can be used to produce ratings.

Not surprisingly, in a survey commissioned by the WBCSD in early 2018, in which around 60 companies took part, more than half said they respond to over 10 ESG ratings and rankings per year. The scope and level of detail of the questionnaires often require considerable resources from every area of the company.

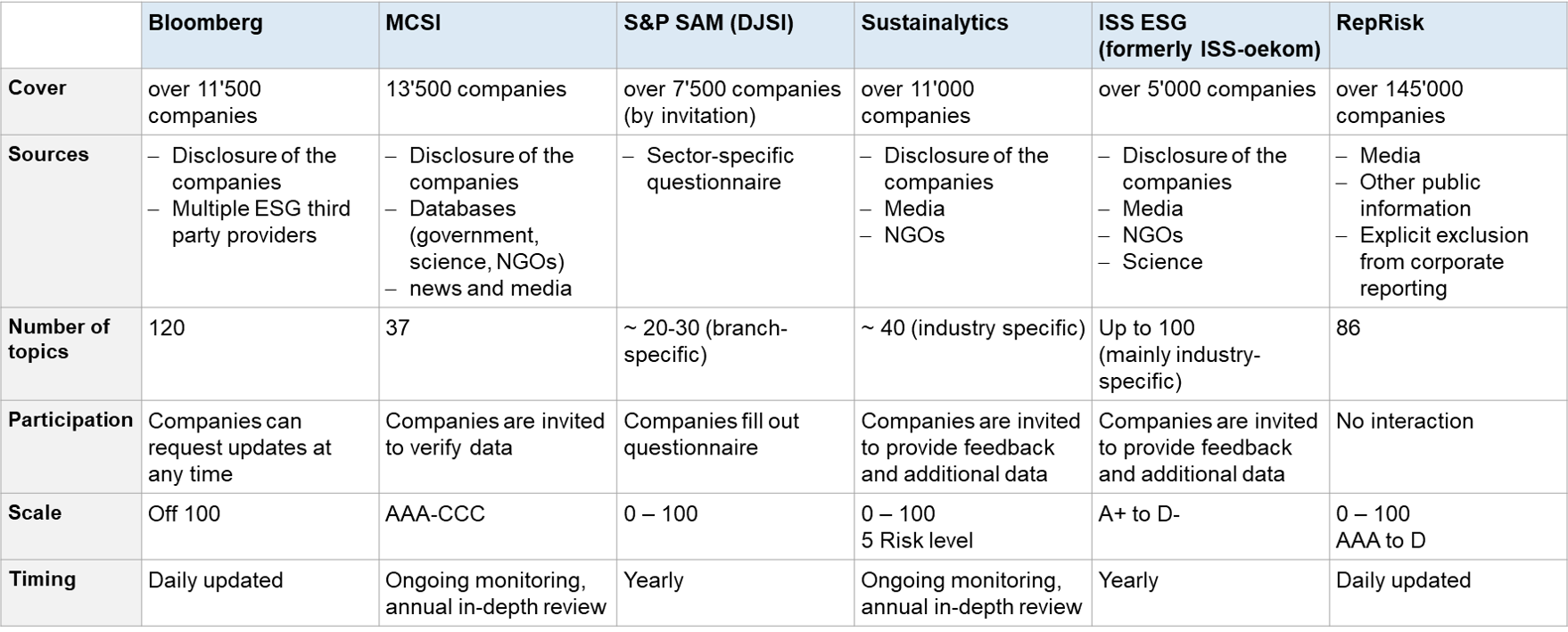

Comparing ESG ratings and rankings agencies

There are generally three types of ESG ratings and rankings agencies:

- Fundamental data provider: These typically offer a broad range of publicly available raw data, usually from company reports, or company websites. Examples include Bloomberg and Refinitive (formerly Thomson Reuters).

- Comprehensive data provider: These mostly offer a combination of publicly available data from media, non-governmental organizations and company reports, and own proprietary questionnaires as well as curated data processed by the agencies’ own analysts. Comprehensive data providers span all ESG aspects. Examples include Sustainalytics, MSCI, TruValue Labs (FactSet), ISS ESG and V.E (formerly known as Vigeo Eiris, an affiliate of Moody’s Corporation). RepRisk also is considered a Comprehensive data provider; however, it intentionally excludes self-reported company data as a central part of its approach.

- Specialized data provider: These mostly offer in-depth and highly contextualized data covering one or two ESG aspects, such as human rights or climate change. These are helpful for investors attempting to improve in a specific ESG domain. Examples include CDP (formerly Carbon Disclosure Project) and TruCost (now part of S&P Global).

As shown in Table 1, even among the major ratings there are significant differences in how many companies they cover, their sources of information, the number of topics they address, how companies can participate, their rating scale and how often they update their ratings, from daily to yearly. Long story short, there is no single “go to” rating that a company should participate in.

Where ratings and rankings can fall short

The quality of the data and information provided by companies is often a problem for ESG ratings and ESG ratings do not always contain correct information.

Also, differences in the way rating agencies calculate ESG scores can result in the same company being rated high by one provider and low by another. For a deeper explanation of this problem, the MIT Sloan Sustainability Initiative started the Aggregate Confusion Project, which began with the publication of the paper, “Aggregate Confusion: The Divergence of ESG Ratings,” which investigates the divergence of ESG ratings based on data from six prominent rating agencies. The study breaks down the divergence into three sources: different scope of categories, different measurement of categories and different weights of categories. Also, it detects a rater effect where a rater’s overall view of a firm influences the assessment of specific categories.

Six tips for entering the world of ESG ratings and rankings

Investors often use more than one rating and therefore, it is in a company’s best interest to participate in multiple ratings. Participating in the ESG ratings and ranking space will require discovery and transparency regarding your data. However, the on ramp doesn’t have to be steep. The key is to get in the game quickly and start on a path toward measurable and meaningful participation. If your company is interested in taking greater control of its ESG rating or ranking and ready to be more proactive, we have six tips.

- Listen and understand: Talk to your key investors and hear what they want in terms of ESG frameworks, data and policies.

- Know the competition: The market is highly dynamic. Research your competitors’ ESG information.

- Start small: You cannot respond to many requests at the same time. Set priorities and concentrate first on a selection according to external and internal requirements.

- Do your homework: You need policies and KPIs to demonstrate your commitment to environmental, social and governance improvements. Do a simple gap analysis and start closing the gaps.

- Talk about it: In addition to your sustainability report, develop a simple overview with facts and figures.

- Improve over time: You will not be a top performer right out of the gate. Commit to making small but steady steps.

1 Harvard Business Review: The Investor Revolution

2 Harvard Business Review: Social-Impact Efforts That Create Real Value

3 Harvard Law School Forum on Corporate Governance: The Age of ESG

Get in touch. We are happy to tell you more about it.